As the year draws to a close, it is a good time to review your full financial picture and see how you are tracking towards the goals.

Contribute as much as possible to your 401Ks or IRAs to reduce your tax bill and save for retirement.

401K: Review your 401K contributions and check that you have contributed as much as you intended. The maximum contribution limit for 2025 is $23,500. People 50 and above are allowed additional catch up contributions of $7500.

Backdoor Roth: The Roth IRA is a tax advantaged retirement account in which you put in after-tax dollars and they grow tax free and can be withdrawn tax free starting age 59 ½ . In general Roth IRAs have income limits ($ 165,000 for single filers and $ 246000 for married filing jointly). However it is possible for high-earners to use the Backdoor Roth IRA, in which they contribute to a traditional IRA first and then convert this to a Roth IRA. You can contribute upto $7000 to your backdoor Roth IRA.

You will have until Dec 31 to make 529 contributions to qualify for tax deductions.

If you have set aside pre-payroll deductions for Healthcare Savings Account or Dependent Care Flexible Savings accounts, make sure to use up these benefits before the end of the year, especially if they are ‘use-it-or-lose-it’ plans. Unused funds are eligible to be forfeited unless they are eligible for a rollover.

Your budget and expenses are literally the biggest factor influencing your financial goals. Your expense levels determine when you can achieve financial independence or whether you can afford that single family home you have set your eyes on.

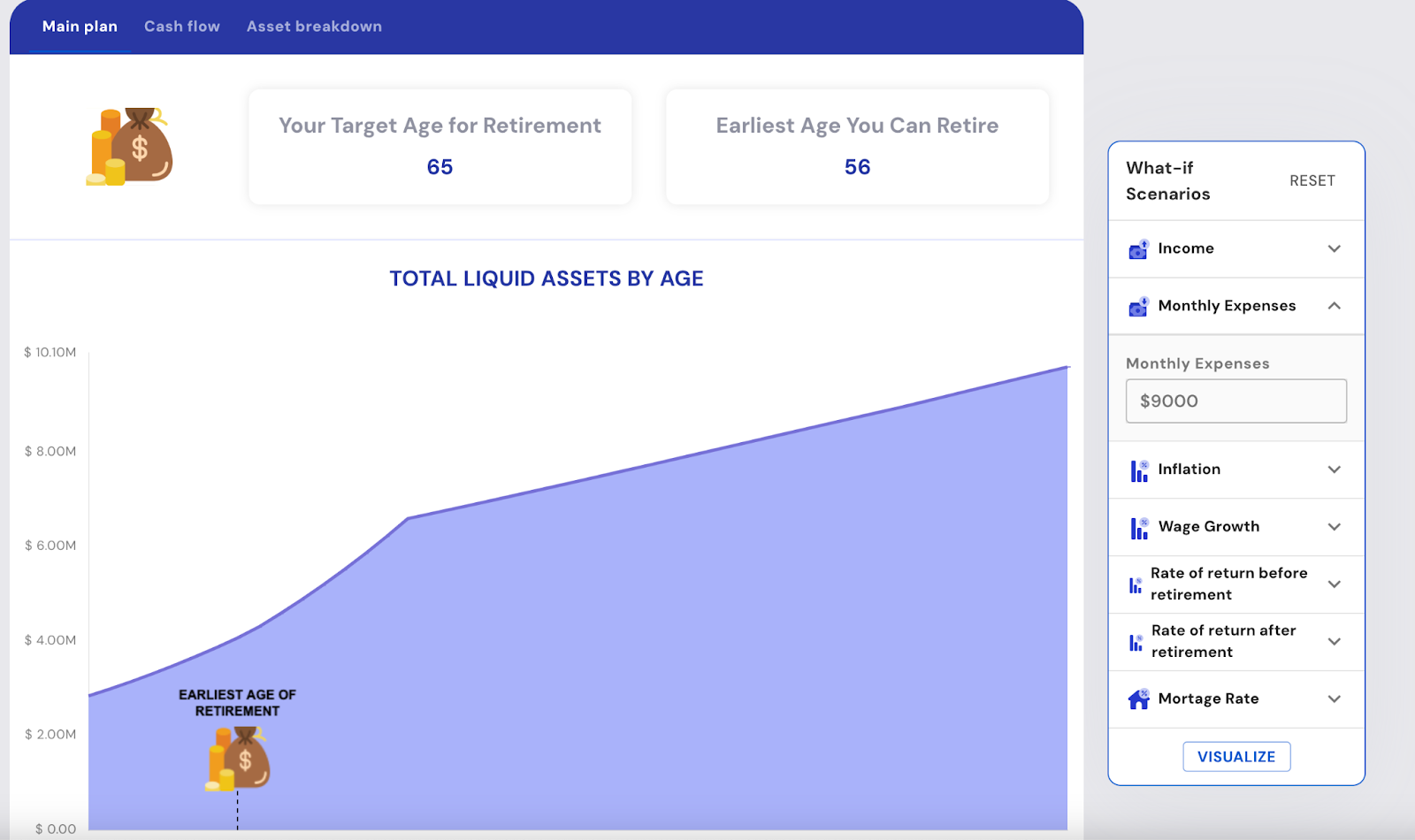

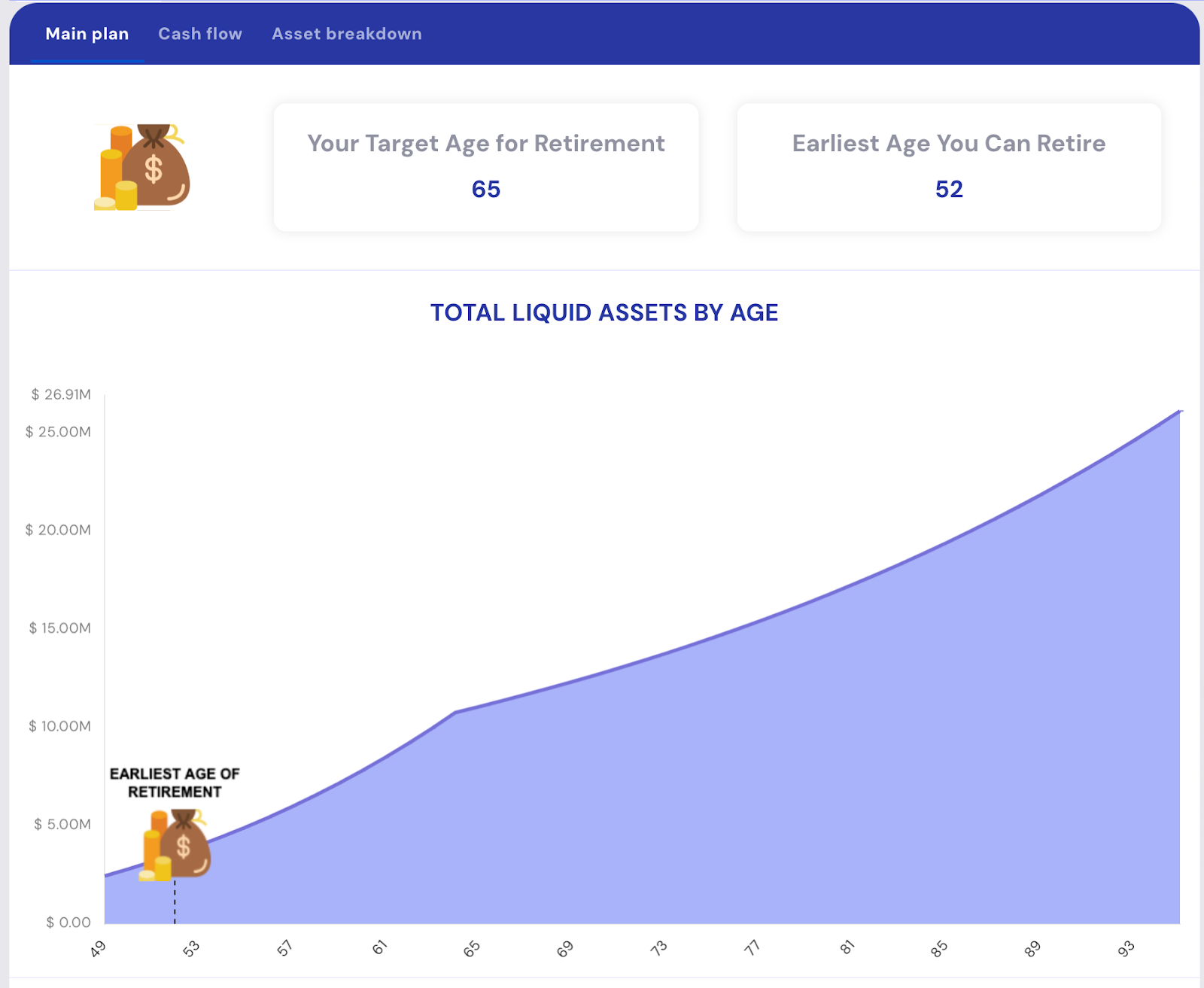

Use Planwell’s ‘What-if’ features to model the impact of expense levels on your goals such as retirement, home buying and other goals.You will see that reducing expenses even a little bit, can have a huge impact on your net worth and goals attainment.

Emergency funds

It is a good practice to keep emergency savings of about 6 months in cash or CDs. Review your finances to make sure you have enough for a rainy day.

Too much cash?

Many professionals can go the other extreme and hold too much of their funds in cash or CDs instead of investing for higher returns. If you have more than 6-12 month’s money in cash, it may be a good idea to invest it in low-cost index funds or use the Boglehead investment approach.

Make a full list of all your long-term and short-term goals.

Do you wish to achieve financial independence or retire by a certain age? You can run the numbers to figure out whether you will have enough money for retirement and the soonest you can retire at. You can also model out different inflation and rates of return and build out conservative or aggressive scenarios.

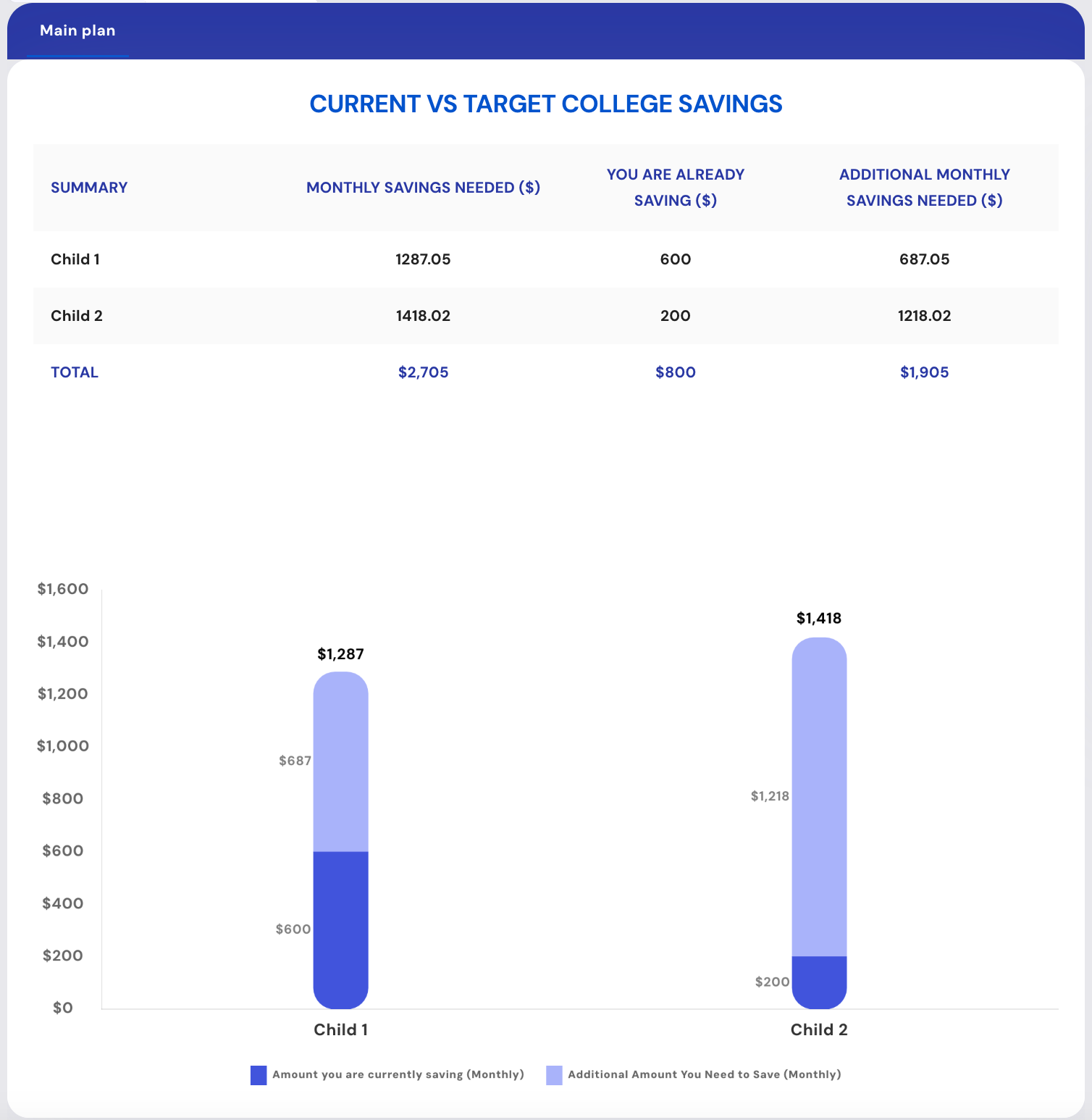

First determine how much to save for your kids’ college. Planwell’s college planning feature crunches the numbers to tell you exactly how much to save for kids’ college every month. It allows you to consider different scenarios such as public (in-state or out of state), or private college.

You may also want to think about what percentage of college you will fund vs how much student loans your kid can take. Some families want to pay for all of their kids’ college if they can afford it, so that kids do not have to graduate with debt. Others, on the other hand, may choose to fund 50% or 75%. This could be both for reasons of affordability and also to teach kids to be financially independent.

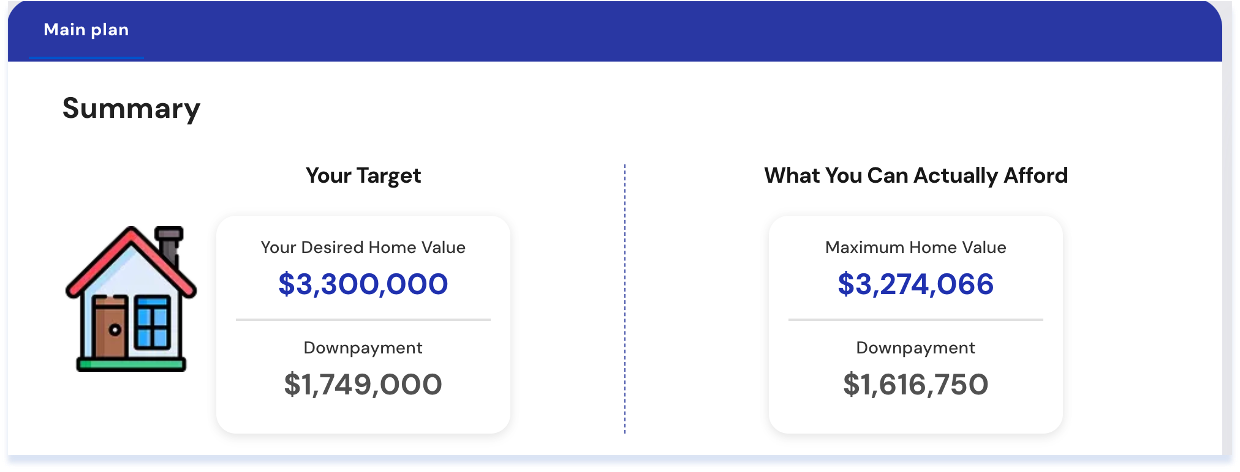

Firstly, make sure you understand how much house you can afford. Lenders have a standard rule of thumb based on debt ratios, but you need to also understand exactly what you can personally afford based on your lifestyle and expense levels.

Secondly figure out whether you are on track to save up for down payment. If not, how much do you need to save every month to achieve your down payment target?

Planwell’s ‘Home Buying’ feature computes your maximum home affordability based on your cash flow and expense levels. It also tells you your downpayment affordability.

Review all your debt and determine if there are ways you can accelerate your debt payments. If you have any extra cash or money available in brokerage accounts, you may consider paying off debts, especially if they are higher interest debt. You can also run numbers to determine whether to pay down debt or invest in stocks or real estate.

Health insurance

This is the time of the year when most companies have their open enrollments. Review your health insurance elections and update them as needed. Review your healthcare spending (premiums, deductibles etc) and think about whether you want to retain the same plan or opt for a different option based on your anticipated healthcare needs.

Life insurance

You can also select other benefits via your company such as Life or AD&D(Accidental Death and Dismemberment) insurance. Review your life insurance benefits based on your family needs, especially if you have young children or other dependents. You may find that you need to go beyond the basic insurance offered by your company.

Companies offer many employee benefits that tend to be overlooked. The end of the year is a good time to look through all the benefits that your company has to offer and sign up for services or benefits that might come in useful.

Review your asset allocation in the light of (1) your financial goals (2) time horizon for the goals (3) your risk tolerance. Rebalance your portfolio, if you feel that your asset allocation is not in line with the above factors.

You can sell loss-making investments in taxable accounts to offset capital gains. Any remaining losses can be used to offset about $3000 of income tax, and the remainder can be carries forward to future years. So if you see any stocks or investments in your accounts that are trading at a loss and unlikely to recover, you could consider tax loss harvesting to offset any capital gains.

The end of the year is also a good time to review your charitable giving initiatives. This is a good opportunity to get tax deductions while donating to causes close to your heart. Make sure to get your company match.

Hat-tip: Check to see if your company benefits include legal services. If so, sign up and use these benefits to pay for estate planning legal fees.

Planwell can help you plan for retirement, kids college and other financial goals with our fully automated financial planning tool.

Read our related articles