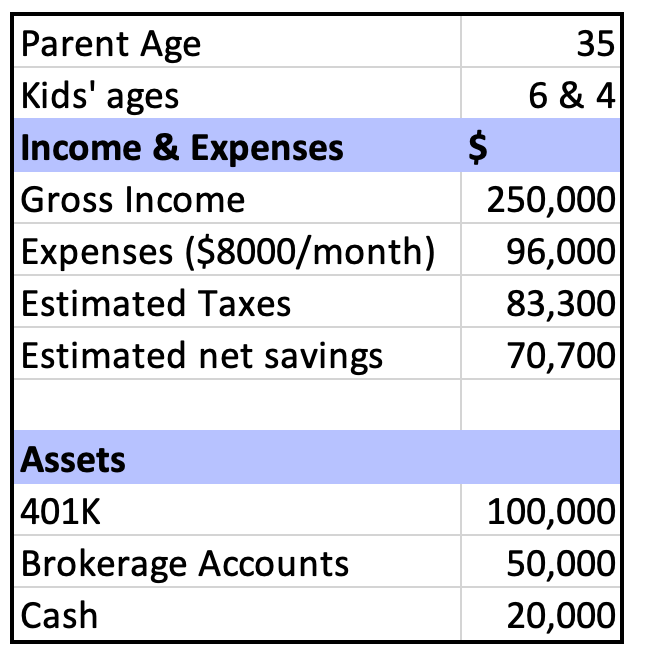

Conventional advice is to prioritize saving for retirement before funding college because shortfalls later in life are hard to make up. However it is best to actually crunch the numbers to find the solution that fits best for your family, rather than relying solely on standard rules of thumb.

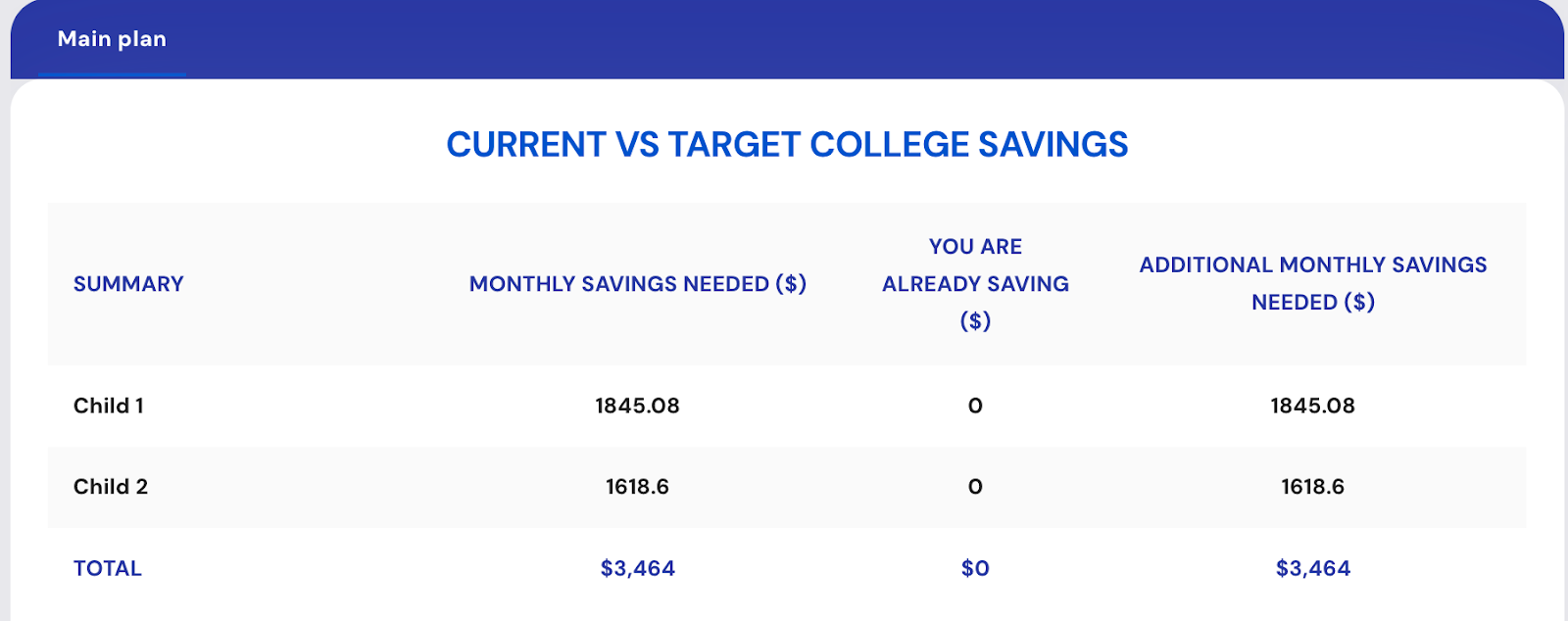

They have not yet saved anything for kids’ college but feel like they are behind on college savings. Ideally, they want to pay for all of their kids’ college so that the kids graduate with zero debt, which is a worthy goal.

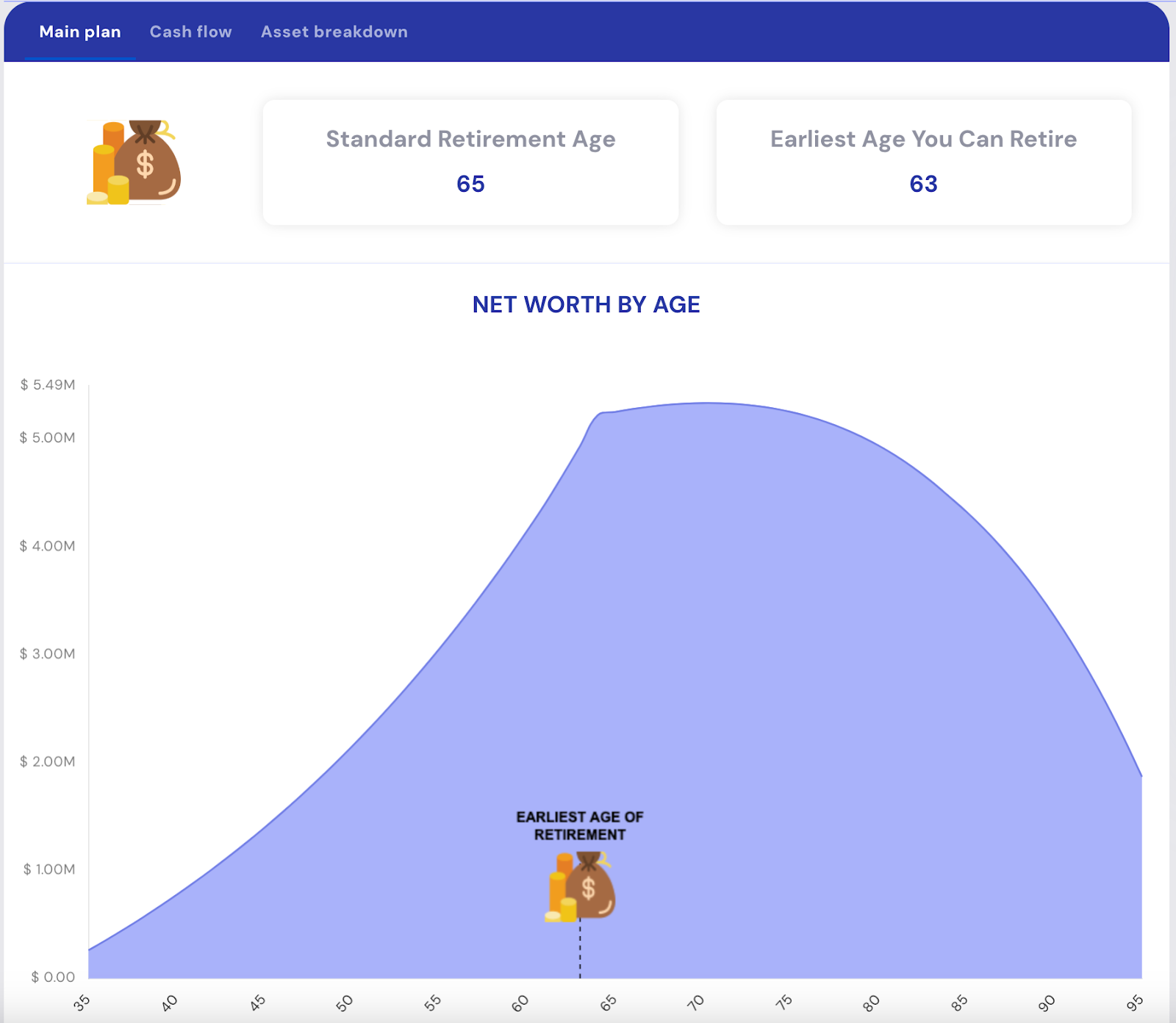

But are they on track for retiring in their mid-60s? And can they also pay for kids’ college?

Assumptions

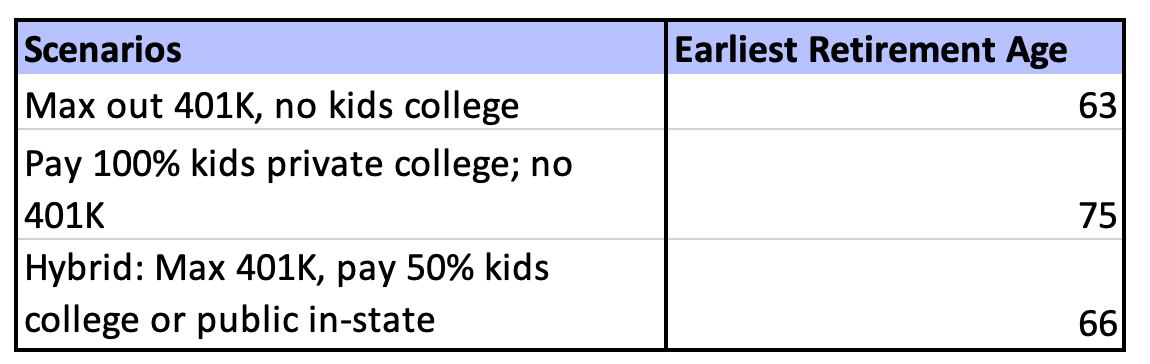

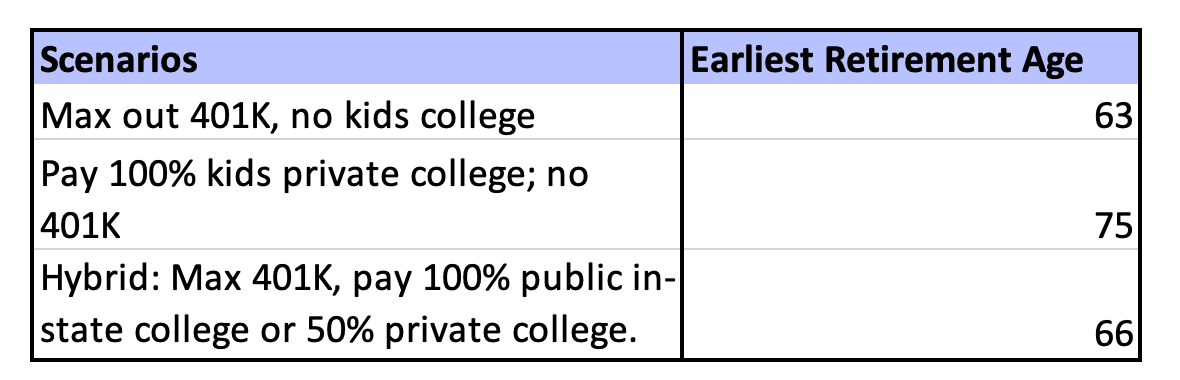

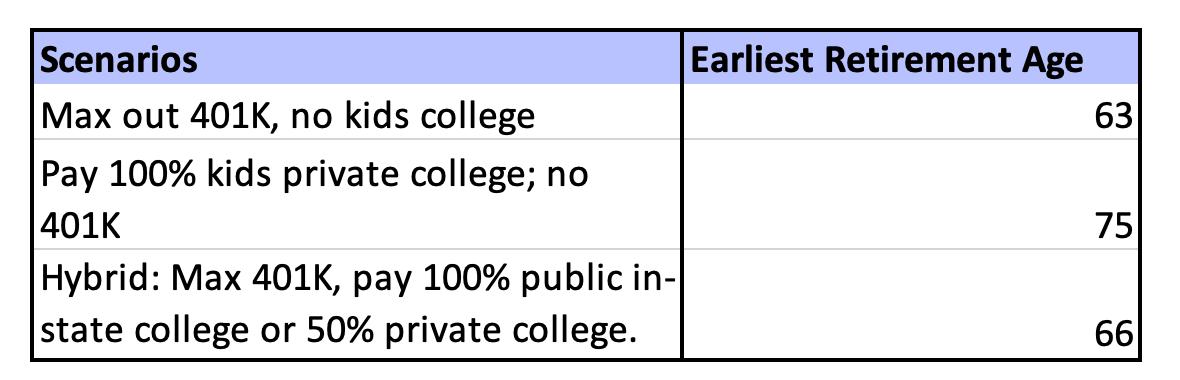

While crunching the numbers with Planwell, here is what we see:

The user can retire comfortably at age 63.

However, they have not saved anything for kids’ college. So that’s a concern.

User retirement gets delayed to age 75, which is a significant delay.

Based on data from the College Board, private college was $244,000 as of 2024. This family would need to put aside $3464 per month until kids turn 18 to pay for full college costs at a private 4-year institution.

Here is how your net worth projection looks like.

This reduces the college expenses by about half, and allows this person to retire at age 66.

Recommended: The hybrid approach that prioritizes retirement but also help put kids through publoic in-state college without tuition or alternatively, pays for 50% of private college.