Design by Freepik

Here's a scenario we recently ran with Planwell's financial planning web app. A 35 year old tech employee working for a FAANG is currently renting in San Francisco. Here is their financial situation.

Summary:

Here's a detailed breakdown of renting vs buying in the Bay Area.

When we ran their financial projection in Planwell, here's what we got. They can comfortably retire at age 65. Their liquid net worth lasts until age 95 (consisting of retirement and taxable accounts).

Same financial situation, except the $5000 in rent is replaced with a home mortgage + property tax.

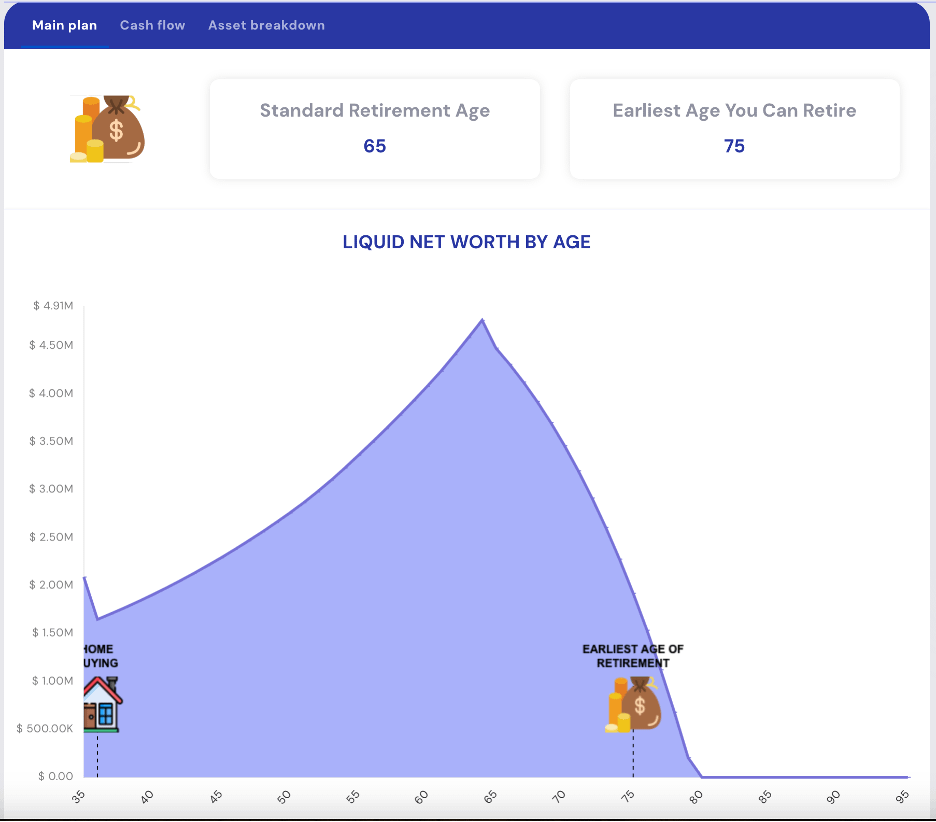

Here are their results: They clearly cannot retire by age 65, in fact they'll have to keep working until they’retill 75.

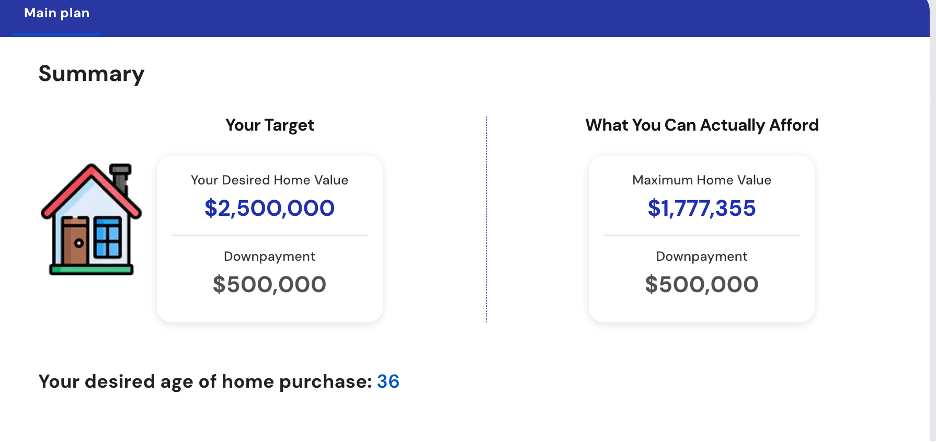

It turns out the maximum home value they can afford and still retire by 65 is $1.7M, not $2.5M.

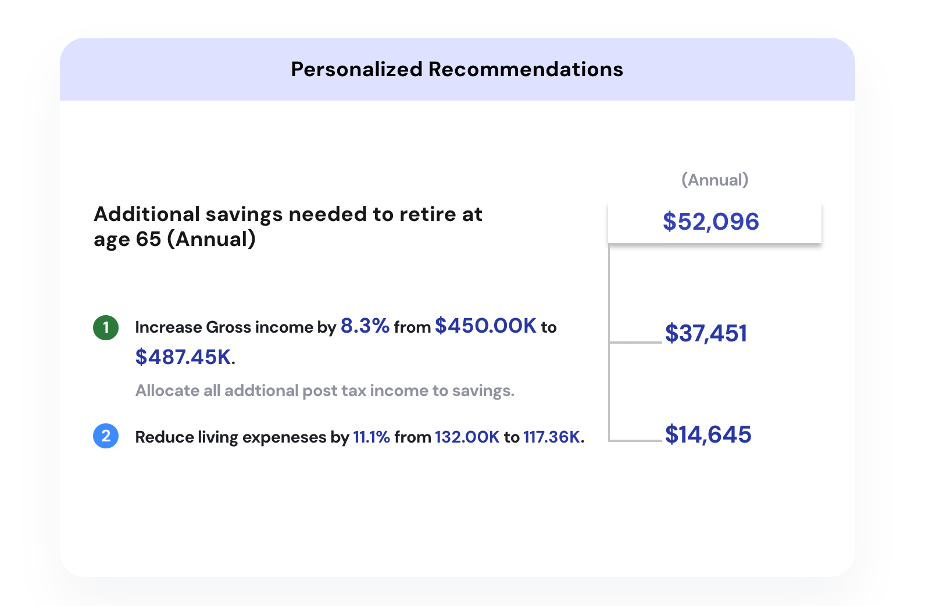

If they want to still buy the $2.5M home, then they will need an additional savings of $52K per year. This can be achieved by boosting their income by 8% (maybe through a new job or promotion) and cutting expenses by 11%.

Personalized recommendation to retire by age 65 - save an additional $52K/ year

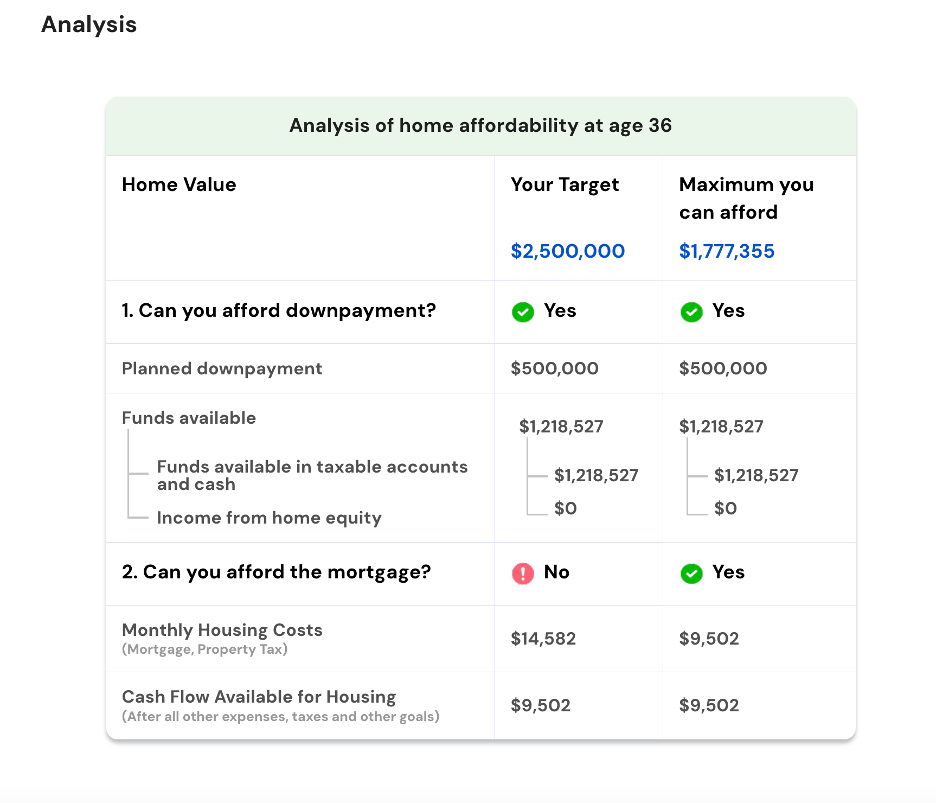

And here is how their home affordability analysis breaks down:

Sign up for Planwell and generate your instant financial plan.