Picture this: your neighbor mentions their kid is starting medical school, and your first thought is probably "they're set for life." After all, doctors make bank, right? Six-figure salaries, fancy cars, big houses. The whole package.

But here's the twist. Many doctors struggle to build real wealth despite those impressive paychecks. Some even reach retirement broke.

The truth is more complex than the stereotype suggests.

Yes, doctors earn substantial salaries. Specialists can pull in $300,000 to $500,000 annually. Even primary care physicians average around $250,000.

But gross salary tells only part of the story.

While many assume doctors are wealthy due to six-figure paychecks, the reality involves more moving parts. Most doctors don't start earning real money until their early to mid-30s. That's after four years of medical school, three to seven years of residency, and possibly fellowship training.

During this time, they accumulate debt instead of wealth.

Then there's the gap between gross and net income. High earners face steep tax brackets. Student loan payments chip away at take-home pay. Practice overhead consumes more chunks of revenue.

What looks like wealth on paper often translates to middle-class reality after expenses.

Medical school costs have exploded. Students routinely graduate with $200,000 to $500,000 in debt. Some owe even more.

This debt doesn't just sit there. It grows with interest during residency when doctors earn modest salaries around $55,000 to $65,000.

But the real cost goes beyond tuition. It's the opportunity cost of lost time.

While their college friends start careers at 22, future doctors spend another decade in training. Those friends get 10+ years of earning, saving, and investing. Compound interest works its magic on their money.

Doctors miss this critical wealth-building window. They start their financial race a decade behind.

The burnout factor adds another layer. Medical training demands extreme hours and stress. Many doctors emerge exhausted, prioritizing immediate comfort over long-term financial planning.

Running a private practice isn't just about seeing patients. It's running a business with serious overhead.

Private practice doctors face mounting costs: staff salaries, rent, equipment, malpractice insurance, billing systems. These expenses can consume 40% to 60% of gross revenue.

Employed physicians dodge overhead but face different challenges. Hospital systems squeeze productivity. Reimbursement rates decline while administrative burdens increase. Many doctors see more patients for the same pay.

Insurance companies complicate everything. Prior authorizations delay care and consume staff time. Denied claims require appeals. Cash flow becomes unpredictable.

The result: doctors often have less control over their income than people assume.

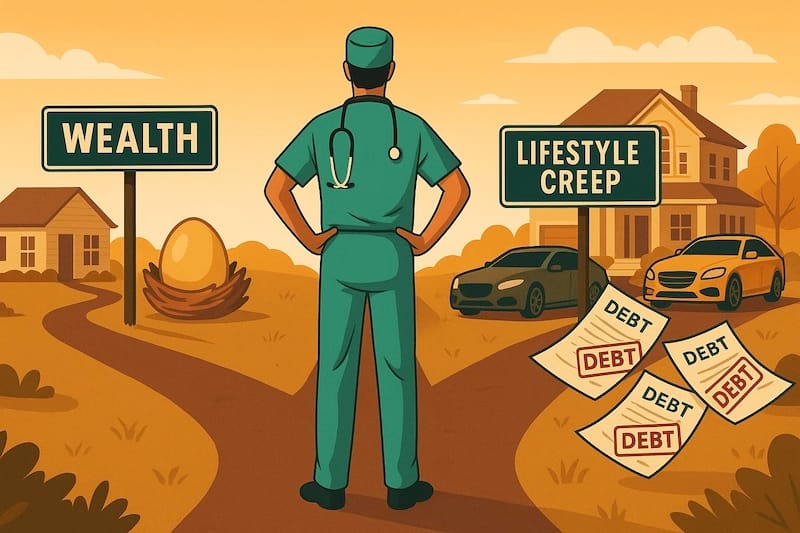

Success brings expectations. Doctors feel pressure to look the part.

The "doctor house" in the best neighborhood. The luxury car befitting their status. Private schools for the kids. Country club memberships.

These lifestyle choices drain cash flow faster than you'd expect.

Time scarcity makes things worse. Busy doctors outsource everything: housekeeping, lawn care, meal prep, tax preparation. These services add up.

Social pressure intensifies the problem. When your colleagues drive Porsches, your Honda feels inadequate. When everyone talks about their vacation homes, you start browsing real estate listings.

Here's the sobering truth: many doctors are poor after retirement despite earning millions during their careers. They spent what they earned instead of investing it.

The good news: doctors can build serious wealth with the right approach.

Start by maximizing retirement accounts. Contribute the full amount to 401(k), Roth IRA, and 457(b) plans if available. These accounts offer tax advantages that compound over time.

Hire a fiduciary financial advisor. Not someone selling insurance products or investment schemes. Find an advisor who works for fees, not commissions.

Avoid "doctor-targeted" investments. These often carry high fees and mediocre returns. Simple, low-cost index funds usually work better.

Live like a resident for a few more years after training ends. Keep expenses low while income jumps. Bank the difference.

The compound effect rewards early action. Can doctors be millionaires? Absolutely. But it requires intentional planning, not just high income.

The physician wealth equation has several components:

High income potential exists, but wealth building starts late. Student debt and opportunity costs create headwinds. Practice overhead and taxes reduce take-home pay. Lifestyle inflation can eliminate savings entirely.

Success comes from understanding these challenges upfront. Smart investing beats flashy spending every time. Early financial planning creates long-term freedom.

Doctors who treat wealth building like a medical procedure tend to succeed. They follow protocols, track progress, and adjust when needed.

The medical profession offers tremendous earning potential. But earning and keeping money require different skills.

Understand that high income doesn't automatically equal wealth. Plan accordingly.

Start early if possible. Every year of delayed investing costs decades of compound growth.

Focus on net worth, not just income. Track assets minus liabilities. This number tells the real story.

At Planwell, we are building a fully automated AI financial planner and advisor to help you make super personalized financial decisions such as how much house you can afford, while considering your lifestyle, retirement goals, and other key factors.

We will be launching the product in the coming months. Stay tuned for an update. Join our waitlist for exclusive access to the free Planwell beta. In the meantime, explore our guides on financial independence and smart planning.